Micro Housing – coming soon to a city near you?

MICRO HOUSING – A micro-apartment, also known as an apodment or microflat, is a one-room, self-contained living space, usually purpose built, designed to accommodate a sitting space, sleeping space, bathroom and kitchenette within around 150–350 square feet.

“Micro housing” is fast becoming a reality in markets all across the country. For those who haven’t heard much about it, micro housing is fully functional living space in a very small square footage blueprint (under 600 square feet).

Japan has been building micro housing units for years. It is now a very important part of urban markets everywhere. New York, Boston, Washington D.C., San Francisco, Chicago, Seattle and even Cleveland have micro housing product. Micro housing is also huge in Canadian markets such as Vancouver and Toronto where it is a much-needed segment of the market.

Micro housing is not only a solution for buyers who can’t afford larger space. In fact, in some markets micro housing is the preferred high-demand product type for a certain segment of the population. Micro housing is generational and lifestyle-driven by Baby Boomers wanting to have a small space in urban communities and young professionals wanting to be close to work and to the urban hub. Additionally, consider that a large part of our population is single. Back in the 1950s, the United States’ adult population was about 10% single. Today that number is closer to 40%. Single people require smaller living spaces than their coupled counterparts. With younger people choosing to get married later in life with higher rates of divorce coupled with Baby Boomers wanting spaces in urban areas along with young professionals – this all adds up to a much greater demand for micro housing.

Urban areas are beginning to recognize the need for micro housing in their urban centers. While in the past, a larger living area was required, in many cities across the country, planning and development departments are beginning to regulate micro housing as a separate entity. This is a clear indication that they are beginning to see the reality of its long-term place in the market and eyeing it as a solution for high-demand areas close to commerce as it also lessens the demand on mass transit the closer to work people live.

Mark my words – micro housing will become the buzz word in real estate in the next two years, just like “short sales” was when the market tumbled. Watch for many more micro housing developments to spring up in urban areas all around the country in years to come.

Portland Condos in Litigation

Four Portland condo buildings tied up in defect lawsuits

A flood of lawsuits over allegedly leaky water pipes has tied up at least four Portland condominium buildings in court, leaving hundreds of condo owners essentially unable to sell their units until the legal wrangling is over.

Owners associations at four Pearl District and downtown Portland condo buildings are suing the supplier of valves, gaskets and other piping products used in the buildings, claiming widespread failures have caused water damage in some units and will cost millions in repairs and temporary relocations.

But for owners and would-be residents, the biggest inconvenience may come from the lawsuits themselves.

Litigation tends to cut off financing for purchases in affected condo buildings, so owners are left to find all-cash buyers. Or, more likely for many, just wait things out.

Identical products were installed in many other area buildings during the condo boom of the mid-2000s, too, meaning the current battle may only be a precursor to an even bigger fight down the road. Property managers in other buildings have notified residents they're inspecting the plumbing and examining their options.

"This is so widespread," said Brad Golik, a broker with Windermere Northwest Real Estate, said of the products. "This is something that's fairly new to Portland."

The litigation — and the threat of more litigation — has cast a pall over the Portland condo market, real estate brokers say, at a time when sales are improving and developers are once again considering new condo construction.

Ben Andrews of Willamette Realty Group said it's creating a stigma for central-city condos over what he considers a relatively minor issue.

"It seems like this is a little blown out of proportion," Andrews said. "It puts a cloud over the condo market."

In the current case, the owners associations of the Elizabeth Lofts, the Avenue Lofts, the Benson Tower and The Edge Lofts have all filed lawsuits against Victaulic Co., a Pennsylvania company that supplied the products the owners say are failing and causing "widespread property damage." Together, the buildings comprise 621 condo units.

The associations are each seeking at least $2 million in damages, including replacing the Victaulic components, repairing earlier water damage and moving residents out while repairs are completed.

Victaulic did not return calls last week seeking comment. In court documents, the company says its suppliers should be held responsible if the parts were defective, though it denies they were.

Attorney Michelle McClure, who represents the four buildings in the lawsuits, also declined to comment, citing an expected gag order from the court.

She didn't want to talk about the possibility of other affected buildings, either, saying she couldn't discuss "potential future clients."

The associations say in filings that repairs — which will involve accessing plumbing systems through units' walls — will be invasive and messy. They're asking for damages in part to temporarily relocate residents and their belongings.

Without replacing the piping components as a precautionary measure, they say, further damages is "inevitable."

A weekslong trial is set to begin in January in The Elizabeth's case. The others come later in 2014.

And until the trials end, either in a finding or a settlement, financing may be inaccessible.

"Boom, you've got 700 units that can't be sold on the open market," said Andrews.

Secondary mortgage investors Fannie Mae and Freddie Mac often decline to buy mortgages for condo buildings involved in litigation, so many lenders won't offer them. If any do, it will be at a higher rate and typically with lots of cash up front.

The first lawsuit at The Elizabeth was filed in Multnomah Circuit Court in 2010. The others joined with lawsuits in U.S. District Court this year, with The Benson filing most recently in June.

Most homeowners who had hoped to sell will have stay put until the cases are resolved — if they have a choice. Others who have to leave, making a job change, for example, may rent out the unit, though many condo associations institute caps on the number of units that can be rented in the building.

Anyone else will have to find an all-cash buyer.

"When you remove all the potential buyers who need a loan, you're left only with cash buyers, and a cash buyer tends to be able to drive a harder bargain," said John Becker principal broker at Realty Trust Group. "They know they're the only person around to buy it."

Another lawsuit involving a Portland condo building illustrates the impact.

When the owners association at The Meriwether on the South Waterfront sued the building's developer in December 2011 over leaks and other issues, sales plummeted.

All 2012 transactions — just two-thirds the number seen in just the first seven months of this year — were made in cash, Becker said. (That suit ended was settled out of court earlier this year.)

The more recent cases may be easier on homeowners because the cost and scope of repairs is much smaller.

"The boards and the management companies totally recognize the impact this has on the owners," Becker said. "They were respectful of the impact this has on people who have to sell property."

But the litigation has put buyers on alert, said Andrews.

Rather than risk the hassle of buying at one of the affected buildings — or any built around the same time period, for fear the parts might cause a problem in the future — they're more likely to look at older buildings where it's a nonissue.

"There are a ton of buyers that are pent up, waiting on the sidelines, to see what happens," Andrews said.

Oregonlive.com 8/17/13

Portland Housing Prices are going up

Home prices, including distressed sales, rose 4.6 percent nationwide in August compared to a year earlier, the largest year-over-year increase since July 2006. The August increase marks the sixth-consecutive monthly home price increase.

In the Portland-Vancouver-Hillsboro metro area, home prices, including distressed sales, were up 4 percent in August compared to a year earlier and up 1.1 percent compared to July. In SW Portland, the area that runs from downtown to Beaverton, and south to Tigard, prices were up over 8%.

If you'd like to know what's happening in your neighborhood, check in at caryperkins.com. I'll keep running statistics available so you know when it's time to go!

Excellent article on the Real Estate Rebound

Maybe you think Realtors are being optimistic when we say that the market is coming back. We are, I believe, optimists by nature. This job isn’t for the faint of heart, especially in the last few years when up to 40% of the Realtors left the business. But here is Barrons joining in our argument that we are on the mend.

Not only that, the article predicts 30% growth in the next 10 years. Payback. If you were waiting for the bottom, wait no longer. Let’s go house shopping.

The 3.8% Tax Effective January 2013

To get you up to speed about this new tax legislation, the NATIONAL ASSOCIATION OF REALTORS® has developed this informational brochure.

On the following pages, you’ll read examples of diff erent scenarios in which this new tax — passed by Congress in 2010 with the intent of generating an estimated $210 billion to help fund President Barack Obama’s health care and Medicare overhaul plans — could be relevant to your transaction.

Understand that this tax WILL NOT be imposed on all real estate transactions, a common misconception. Rather, when the legislation becomes eff ective in 2013, it may impose a 3.8% tax on some (but not all) income from interest, dividends, rents (less expenses) and capital gains (less capital losses). The tax will fall onlywillon individuals with an adjusted gross income (AGI) above $200,000 and couples filing a joint return with more than $250,000 AGI.

For more information, please click here.

Facebook

Facebook

X

X

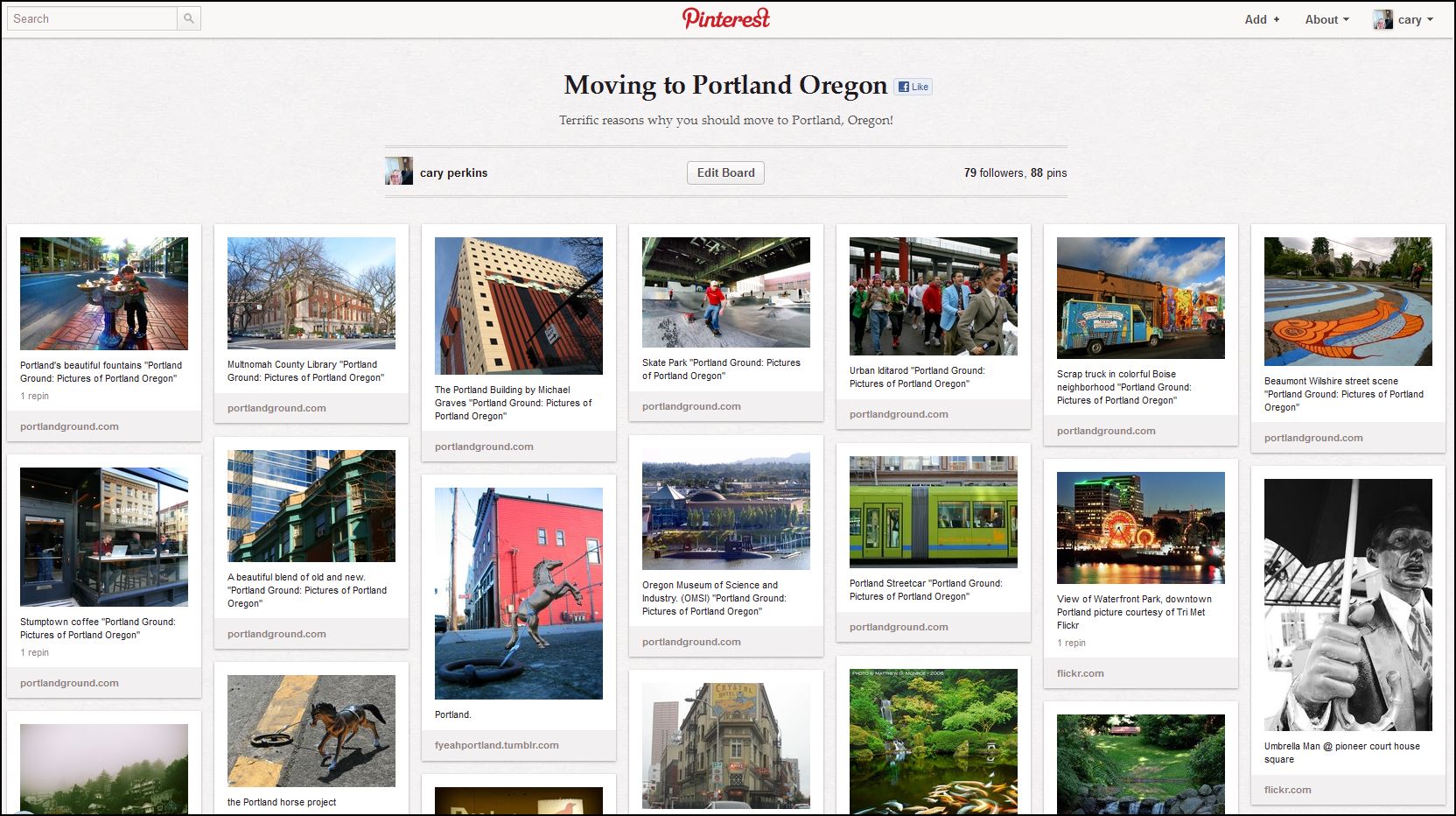

Pinterest

Pinterest

Copy Link

Copy Link