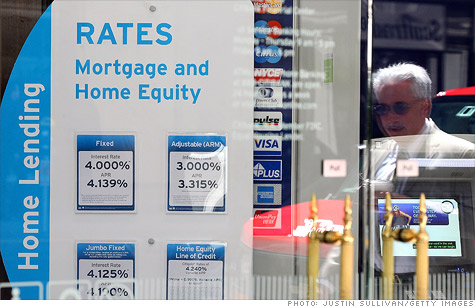

I have a feeling that we will look back on this time and wish we had bought more real estate. Prices are still declining just a tiny bit in SW Portland (though rising in other parts of town) and interest rates are still AMAZINGLY low.

Now there's even more reason to get in the game – lenders have finally reined in closing costs. They were down by 7% in the last year, thanks to Federal regulations, which are helping to significantly reduce the amount new homebuyers are paying come closing time.

The average cost of closing on a mortgage has fallen by 7.4% over the past year, according to a recent survey by Bankrate.com. At the end of June, a homebuyer looking to close on a $200,000 mortgage with 20% down paid an average of $3,754, $300 less than 12 months earlier.

Included in those costs are origination expenses, such as application fees and the cost of doing credit checks, and third-party fees, such as those paid for title searches and insurance.

The decline can be attributed to new regulations that require lenders to be more accurate when estimating closing costs for borrowers, said Greg McBride, Bankrate's senior financial analyst.

The regulation, which was put in place two years ago as part of the Real Estate Settlement Practices Act requires lenders to provide a "good faith estimate" of third-party fees that is within 10% of the actual amount the buyer will pay.

"The big drop in third-party fees indicates the lenders are doing a better job at estimating what the costs will be," said McBride.

source: NEW YORK (CNNMoney) —

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link